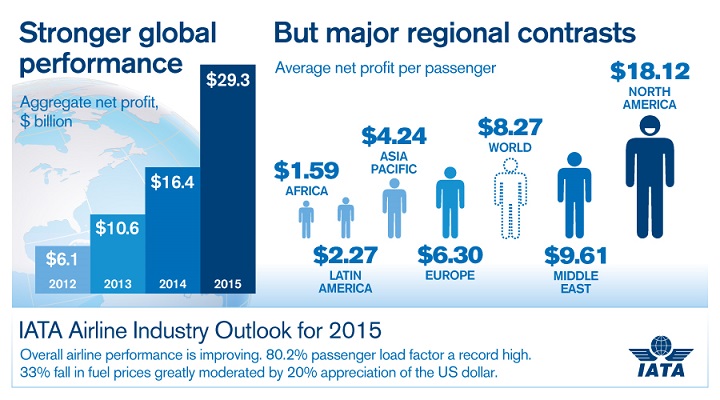

The International Air Transport Association (IATA) announced an upward revision of its 2015 industry outlook to a $29.3 billion net profit. On expected revenues of $727 billion, the industry would achieve a 4.0% net profit margin. The significant strengthening from the $16.4 billion net profit in 2014 (re-stated from $19.9 billion) reflects the net impact of several global factors, including stronger global economic prospects, record load factors, lower fuel prices, and a major appreciation of the US dollar.

All regions are expected to see an improvement in profitability in 2015 compared with 2014.There are, however, stark differences in regional economies, which are also reflected in airline performance. "The industry"™s fortunes are far from uniform. Many airlines still face huge challenges," said Tony Tyler, IATA"™s Director General and CEO.

Over half the global profit is expected to be generated by airlines based in North America ($15.7 billion). For North American airlines, the margin on earnings before interest and taxation (EBIT) is expected to exceed 12%, more than double that of the next best performing regions of Asia-Pacific and Europe.

"For the airline business, 2015 is turning out to be a positive year. Since the tragic events of September 2001, the global airline industry has transformed itself with major gains in efficiency. This is clearly evident in the expected record high passenger load factor of 80.2% for this year. The result is a hard-earned 4% average net profit margin. On average, airlines will retain $8.27 for every passenger carried," said Tony Tyler, IATA"™s Director General and CEO.

"Let"™s keep things in perspective. Apple, a single company, earned $13.6 billion in in the second quarter of this year. That"™s just under half the expected full-year profit of the entire airline industry. We don"™t begrudge anyone their business success. But it is important for our stakeholders, particularly governments, to understand that the business of providing global connectivity is still a very tough one," said Tyler.

At the industry level, a significant milestone has been achieved with an expected return on invested capital (ROIC) of 7.5%. For the first time, the industry-level average ROIC will be in excess of its cost of capital, which has fallen to 6.8% largely due to lower bond yields. This industry average is, however, dominated by airlines in the United States, which have benefitted the most from the fall in US dollar-denominated fuel prices, a strong local economy, and industry restructuring. The average non-US airline is still struggling with returns below the cost of capital and a significant debt burden.

Main Forecast Drivers

"¢ Fuel prices : The recent decline in fuel prices is a welcome development. The 2015 industry outlook is based on an average Brent crude oil price of $65/barrel, which is 36% below the 2014 price of $101.4. Jet fuel prices are expected to decline at a slower rate for a full year price of $78/barrel (33% below the $116.6 level of 2014). Fuel still represents approximately 28% of the industry"™s operating cost structure. And the full impact of the fall in fuel prices is being moderated by a 20% rise in the value of the US dollar over the past 12 months as well as by airline hedging policies, which have locked about half of the 2015 fuel supply at higher levels.

"¢ Revenues : The impact of the stronger US dollar can be seen in a 0.7% decline in the industry"™s overall revenues, which are expected to be $727 billion ($733 billion in 2014).

"¢ Passenger: The passenger business is expected to grow some 6.7% in 2015, an acceleration on the 6.0% growth recorded in 2014. Passenger numbers are still expected to top 3.5 billion for the first time in 2015. A focus on efficiency is seeing supply matched more closely than ever with demand and is expected to produce a record high load factor of 80.2%. A yield decline of 7.5% reflects the stiff competition in the business but is exaggerated by the impact of the US dollar appreciation.

"¢ Cargo : The cargo business is expected to grow 5.5% this year, which is a slightly slower pace than the 5.8% realized in 2014. There was a strengthening of the cargo business in 2014 that continued into this year. Expected revenue"”estimated at $62 billion"”would have exceeded the $67 billion peak in 2011 were it not for the appreciation of the US dollar. The improvement is delivered through a volume increase with a record 54.2 million tonnes of air cargo expected in 2015. Yields are expected to fall around 7% this year (a decline that is again exaggerated by the strength of the US dollar). The longer-term prospects for air cargo remain challenging with a continuing post-financial crisis trend of slower trade growth relative to GDP.

The regions

All regions will see improved profitability in 2015 compared with 2014. They will also see capacity expansions but these are expected to broadly match the expansion in demand. This aligns with the global expectation for capacity to expand 6.2%, slightly behind the projected 6.7% increase in demand. Aside from these few similarities, the regions are expected to deliver widely divergent levels of profitability.

"¢ North America : Carriers in North America are expected to generate a profit of $15.7 billion (up from $11.2 billion in 2014) for a net margin of 7.5%. On a per passenger basis this translates to an average profit of $18.12. Airlines in the United States have been able to use this profitability to invest in new fleet, pay down high levels of debt and deliver a normal return to investors through dividends and share buy-backs. This has been driven by the relatively strong economy, a restructured industry, and the lower oil price. The region is expected to see a 3.0% growth in demand, although capacity is starting to pick up with an anticipated 3.1% expansion.

"¢ Asia-Pacific : Carriers in the Asia-Pacific region are expected to generate a $5.1 billion profit for a 2.5% net margin ($4.24/passenger). Asia-Pacific airlines have about a 40% share of the global air cargo market. Consequently, they have been disproportionately impacted by the doldrums in the air cargo industry. The slowdown in the Chinese economy has also had a dampening impact on profitability. Demand is expected to grow a healthy 8.1%, slightly ahead of the 7.7% forecast growth in capacity. Lower fuel costs will help but the stronger dollar reduces the benefit in this region.

"¢ Europe : European airlines are expected to post a collective profit of $5.8 billion in 2015 for net margin of 2.8% ($6.30/per passenger). The prospects for airlines based in the region have improved slowly over the last two years. This is particularly true for network airlines serving the North Atlantic, which looks set to continue generating decent returns. Long-haul markets have been stronger than home markets, which have been depressed by the ongoing debt problems of Southern Europe. Economic growth is starting to pick up even in Southern Europe and has been adjusted upward in 2015. Airlines in the region are expected to add 6.5% to capacity to meet a 6.8% expansion in demand. European airlines have benefited from lower fuel prices but again this has been limited by the strength of the US dollar. Consequently, growth in profitability is lagging behind that of US airlines. And the region"™s operating environment continues to be hindered by onerous regulation, high taxes, and both infrastructure deficiencies and inefficiencies.

"¢ Latin America : Latin American airlines are expected to return a net profit of $600 million for a net margin of 1.8% ($2.27/passenger). This follows breakeven performance in 2014. The region has delivered weak returns on average for the past few years, largely because of the very poor performance of key economies like Brazil and Argentina. Significant exchange rate weakness against the dollar will substantially limit any benefits from lower fuel prices. This year, demand for the region"™s airlines is expected to grow 5.1%, slightly outpacing a 5.0% expansion of capacity.

"¢ Middle East : Middle Eastern airlines are expected to post a collective $1.8 billion net return for 2015 for an average net margin of 3.1% ($9.61/passenger). The region"™s carriers are expected to see a 12.9% growth in passenger numbers this year, the only region with a double-digit expansion. Airlines in the region have mixed fortunes, some loss-making, others profitable. An improvement in profitability is also expected to be driven by lower fuel costs.

"¢ Africa : African airlines are expected to post a collective profit of $100 million for a net margin of 0.8% ($1.59/passenger), the thinnest of all regions. Although in the black, this continues the relatively poor performance of the past few years. Last year, traffic growth for African airlines was weak because of various problems that disrupted tourism, but market share also continues to be lost. Currencies have been weak, particularly for oil exporters, so the benefits of lower fuel prices will be limited in this region. African airlines are also expected to see the slowest growth among developing markets with capacity and demand expansion of 3.3% and 3.2% respectively this year.

Connectivity, Jobs, Taxes, and Environmental Performance

The airline industry continues to add value to its customers, to the wider economy, and to governments:

"¢ Aviation"™s global connectivity now spans 16,485 city-pairs (2014), which is nearly double the number in 1994. This connectivity is a catalyst for economic benefits for users and the wider economy. Over that same period, average airfares have fallen around 64% (after inflation), which has been a major stimulus for trade, tourism, and foreign direct investment associated with global supply chains.

"¢ The number of aviation jobs is rising although the pace of hiring is expected to taper slightly in 2015. Total direct employment in the sector is expected to reach 2.5 million (up 3.1% on 2014). The total airline payroll in 2015 is expected to reach $150 billion (up from $142 billion in 2014). Compared with 2014, average unit labor costs are expected to fall 0.5% in 2015 as productivity per employee improves 3.2%. Airline employees are also extremely productive for the economies in which they work, generating gross value added (GVA"”the company level equivalent to GDP) of $96,753 per employee in 2015 (up 2.7% on 2014).

"¢ The industry tax bill is expected to grow to $116 billion in 2015. That is a 3.9% increase on 2014.

"¢ Airline"™ environmental performance continues to improve. Airlines are expected to use 288 billion liters of fuel in 2015. In doing so, the industry is expected to emit 757 million tonnes of carbon. While that is a 4.6% increase on the previous year, it is well below the 6.7% growth in passenger demand (RPK) and the 5.5% expected demand growth for cargo (FTK). This is expected to align with the industry"™s fuel efficiency goal of improving its fuel efficiency by 1.5% annually to 2020. Investments in new aircraft are a major driver of fuel efficiency improvements. In 2015, airlines are expected to take delivery of more than 1,700 new aircraft worth $180 billion. About half are expected to replace less fuel-efficient older aircraft.

"¢ The industry remains committed to achieving carbon-neutral growth from 2020. This is in addition to a 1.5% average annual improvement in fuel efficiency to 2020 and complements the long-term goal of cutting net emissions in half by 2050 (compared with 2005 levels).