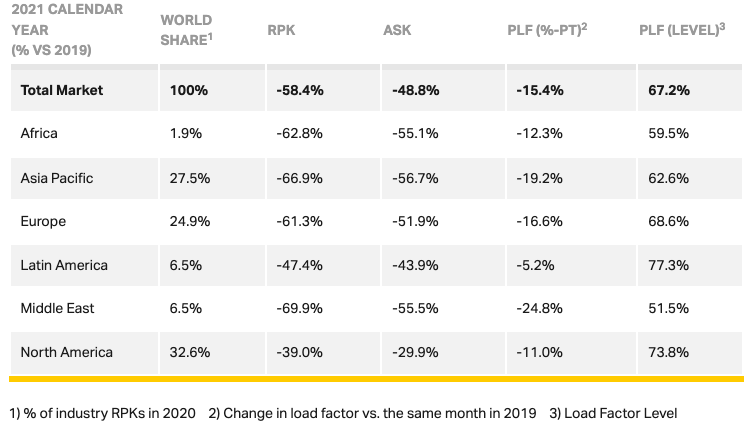

The International Air Transport Association (IATA) announced full-year global passenger traffic results for 2021 showing that demand (revenue passenger kilometers or RPKs) fell by 58.4% compared to the full year of 2019. This represented an improvement compared to 2020, when full year RPKs were down 65.8% versus 2019.

Because comparisons between 2021 and 2020 results are distorted by the extraordinary impact of COVID-19, unless otherwise noted all comparisons are to the respective 2019 period, which followed a normal demand pattern.

- International passenger demand in 2021 was 75.5% below 2019 levels. Capacity, (measured in available seat kilometers or ASKs) declined 65.3% and load factor fell 24.0 percentage points to 58.0%.

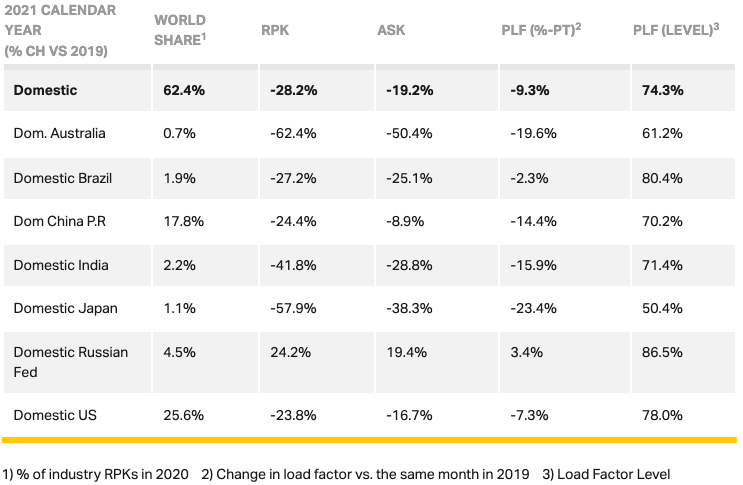

- Domestic demand in 2021 was down 28.2% compared to 2019. Capacity contracted by 19.2% and load factor dropped 9.3 percentage points to 74.3%.

- Total traffic for the month of December 2021 was 45.1% below the same month in 2019, improved from the 47.0% contraction in November, as monthly demand continued to recover despite concerns over Omicron. Capacity was down 37.6% and load factor fell 9.8 percentage points to 72.3%.

- Ticket sales for future domestic and international travel deteriorated since November. Tickets sold for travel at any point in the future were at 45% of 2019 levels in the first half of January – a deterioration compared with 50% in December and 56% in November. This suggests that the traditionally less busy January-February period will be weaker than in the absence of Omicron.

Impact of Omicron Measures: Omicron travel restrictions slowed the recovery in international demand by about two weeks in December. International demand has been recovering at a pace of about four percentage points/month compared to 2019. Without Omicron, we would have expected international demand for the month of December to improve to around 56.5% below 2019 levels. Instead, volumes rose marginally to 58.4% below 2019 from -60.5% in November.

“Overall travel demand strengthened in 2021. That trend continued into December despite travel restrictions in the face of Omicron. That says a lot about the strength of passenger confidence and the desire to travel. The challenge for 2022 is to reinforce that confidence by normalizing travel. While international travel remains far from normal in many parts of the world, there is momentum in the right direction. Last week, France and Switzerland announced significant easing of measures. And yesterday the UK removed all testing requirements for vaccinated travelers. We hope others will follow their important lead, particularly in Asia where several key markets remain in virtual isolation,” said Willie Walsh, IATA’s Director General.

Asia-Pacific airlines’ full-year international traffic plunged 93.2% in 2021 compared to 2019, which was the deepest decline for any region. It fell 87.5% in the month of December, a bit better than the 89.8% decline in November. Full year capacity was down 84.9% compared to 2019. Load factor fell 44.3 percentage points to 36.5%.

European carriers saw a 67.6% traffic decline in 2021 versus 2019. Capacity fell 57.4% and load factor decreased 20.6 percentage points to 65.0%. For the month of December, traffic slid 41.5% compared to December 2019, an improvement over the 43.5% year-to-year decline in November.

Middle Eastern airlines’ annual passenger volumes in 2021 were 71.6% below 2019. Annual capacity fell 57.7% and load factor dropped 25.1 percentage points to 51.1%. December’s traffic was down 51.2% compared to December 2019, a solid pick-up from a 54.3% drop in November.

North American airlines’ full year traffic fell 65.6% compared to 2019. Capacity dropped 52.0%, and load factor sank 23.8 percentage points to 60.2%. December demand was down 41.7% compared to the same month a year-ago, a pick-up over a 44.6% drop in November.

Latin American airlines had a 66.9% full year traffic decline compared to 2019. Capacity fell 62.2% and load factor dropped 10.2 percentage points to 72.6%, the highest among regions. Traffic fell 40.4% for the month of December compared to December 2019, significantly bettering the 47.3% decline in November.

African airlines’ international traffic fell 65.2% last year compared to 2019, which was the best performance among regions. Capacity dropped 56.7%, and load factor sank 14.1 percentage points to 57.3%. Demand for the month of December was 60.5% below the year-ago period, a deterioration from the 56.5% decline in November, owing to the impact of government travel restrictions in response to Omicron.

China’s domestic passenger traffic fell 24.4% in 2021 compared to 2019. It was down 39.6% for the month of December versus December 2019, which was an improvement compared to a 50.9% decline in November.

Russia’s domestic traffic rose 24.2% for the full year, and 23.2% for the month of December, an acceleration over the 17.5% rise in November. Russia was the only market to see growth in RPKs in 2021 compared to 2019.

The Bottom Line

“As COVID-19 continues to evolve from the pandemic to endemic stage, it is past time for governments to evolve their responses away from travel restrictions that repeatedly have been shown to be ineffective in preventing the spread of the disease, but which inflict enormous harm on lives and economies. A New Year’s resolution for governments should be to focus on building population immunity and stop placing travel barriers in the way of a return to normality,” said Walsh.

- View detailed Air Passenger Market Analysis 2021 (pdf)

- View media briefing presentation: Overview of air transport in 2021 (pdf)