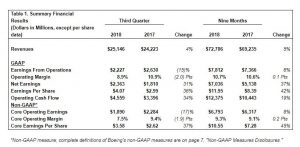

The Boeing Company [NYSE: BA] reported third-quarter revenue of $25.1 billion driven by higher defense volume and services growth (Table 1). GAAP earnings per share increased to $4.07 and core earnings per share (non-GAAP)* increased to $3.58 primarily driven by strong operating performance at Commercial Airplanes and a tax benefit related to a tax settlement ($0.71 per share). Results also reflect charges related to planned investments in the newly awarded T-X Trainer and MQ-25 programs ($0.93 per share). Boeing delivered strong operating cash flow of $4.6 billion, repurchased $2.5 billion of shares, and paid $1.0 billion of dividends.

The company’s revenue guidance increased $1.0 billion to between $98.0 and $100.0 billion, driven by defense volume and services growth, inclusive of the KLX acquisition. Operating cash flow guidance is reaffirmed at $15.0 to $15.5 billion. Full year GAAP earnings per share guidance is increased to between $16.90 and $17.10 from between $16.40 and $16.60 and core earnings per share (non-GAAP)* guidance is increased to between $14.90 and $15.10 from between $14.30 and $14.50 driven by a lower-than-expected tax rate and improved performance at Commercial Airplanes.

«Our teams continued to perform at a high level during the quarter, driving solid operating performance and robust cash generation, and continuing to deliver on our One Boeing advantage by bringing the best of Boeing to our customers,» said Boeing Chairman, President and Chief Executive Officer Dennis Muilenburg.

«During the quarter we captured important new defense business, winning and investing in the MQ-25 and T-X programs and securing the MH-139 contract, clearly demonstrating the value Boeing brings to customers while positioning us well for future growth opportunities. Within the Commercial Airplanes business, the 777X static test airplane was completed and moved into test setup and the team’s focus on execution across our production programs continued to drive outstanding performance and strong operating margins. Our Global Services business continues to deliver on total lifecycle value to our customers, with key wins in the quarter including P-8 Poseidon training contracts for the U.S. Navy and Royal Australian Air Force and an order from GECAS for 20 737-800 Boeing Converted Freighters. Additionally, we began integrating new data analytics tools, powered by Boeing AnalytX, into all Boeing Defence Australia support contracts, enhancing its position as a leading fleet services provider in the region.»

«This strong underlying performance, along with growth across our businesses we’ve seen throughout the year, give us confidence to raise our 2018 revenue and earnings guidance and reaffirm our operating cash flow guidance.»

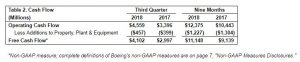

Operating cash flow in the quarter increased to $4.6 billion, primarily driven by timing of receipts and expenditures as well as planned higher commercial airplane production rates and strong operating performance (Table 2). During the quarter, the company repurchased 7.0 million shares for $2.5 billion, leaving $9.6 billionremaining under the current repurchase authorization which is expected to be completed over approximately the next 12 to 18 months. The company also paid $1.0 billion in dividends in the quarter, reflecting a 20 percent increase in dividends per share compared to the same period of the prior year.