Copa Holdings, S.A. (NYSE: CPA), announced financial results for the fourth quarter of 2021 (4Q21) and full year 2021. The terms «Copa Holdings» and «the Company» refer to the consolidated entity. The following financial information, unless otherwise indicated, is presented in accordance with International Financial Reporting Standards (IFRS). See the accompanying reconciliation of non-IFRS financial information to IFRS financial information included in the financial tables section of this earnings release. Unless otherwise stated, all comparisons with prior periods refer to the fourth quarter of 2019 (4Q19) (which the Company believes are more relevant than year-over-year comparisons due to the significant impacts in 2020 of the COVID-19 pandemic).

OPERATING AND FINANCIAL HIGHLIGHTS

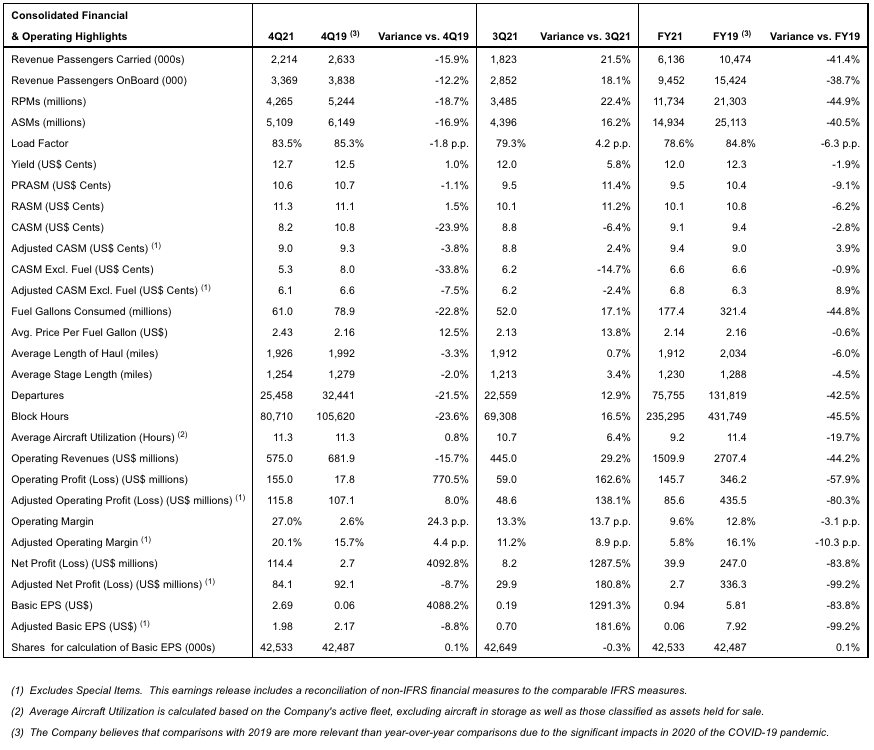

- Copa Holdings reported a net profit of US$114.4 million for the quarter or US$2.69 per share. Excluding special items, the Company would have reported a net profit of US$84.1 million or US$1.98 per share. Special items include an US$8.9 million unrealized mark-to-market loss related to the Company’s convertible notes and a reversal of US$39.2 million in the Company’s provision related to the return of leased aircraft.

- Copa Holdings reported an operating profit of US$155.0 million for the quarter. Excluding the US$39.2 million reversal, the Company would have reported an operating profit of US$115.8 million and a 20.1% operating margin.

- For full-year 2021, the Company reported a net profit of US$39.9 million or US$0.94 per share. Excluding special items, which included a reversal of US$39.2 million in the Company’s provision related to the return of leased aircraft, a US$22.8 million unrealized mark-to-market loss related to the Company’s convertible notes, and a passenger revenue adjustment of US$20.8 million corresponding to unredeemed coupons from 2019 and 2020 sales, Copa Holdings would have reported an adjusted net profit of US$2.7 million or US$0.06 per share.

- For full-year 2021, the Company reported an operating profit of US$145.7 million. Excluding special items, the Company would have reported an operating profit of US$85.6 million and a 5.8% operating margin.

- Capacity for 4Q21, measured in terms of available seat miles (ASMs), was 83.1% of the capacity flown in 4Q19.

- Total revenues for 4Q21 came in at US$575.0 million, reaching 84.3% of 4Q19 revenues. Passenger revenues for 4Q21 reached 82.2% of 4Q19 levels, while 4Q21 cargo revenues were 61.2% higher than 4Q19. Passenger yield increased 1.0% to 12.7 cents and load factors decreased 1.8 percentage points to 83.5%, compared to 4Q19. Revenue per Available Seat Mile (RASM) came in at 11.3 cents, or 1.5% higher than 4Q19.

- Operating cost per available seat mile (CASM) in 4Q21, excluding special items (adjusted CASM) decreased 3.8% vs. 4Q19 to 9.0 cents. While adjusted CASM, excluding fuel, decreased 7.5% to 6.1 cents.

- Cash buildup, defined as cash proceeds minus disbursements, excluding extraordinary financing activities and asset sales but including capital expenditures and payment of financial obligations, was US$84 million for the quarter.

- The Company ended the quarter with US$1.5 billion in available liquidity, consisting of approximately US$1.2 billion in cash, short-term and long-term investments, and US$295 million in committed and undrawn credit facilities.

- The Company closed the quarter with total debt, including lease liabilities, of US$1.6 billion.

- During the quarter, the Company took delivery of one Boeing 737 MAX 9, completed the conversion of one Boeing 737-800 into a freighter, and decided to retain three Boeing 737-700s previously classified as assets held for sale.

- Including 3 Boeing 737-700 aircraft currently in temporary storage and one Boeing 737-800 freighter, Copa Holdings ended the year with a consolidated fleet of 91 aircraft – 68 Boeing 737-800s, 14 Boeing 737 MAX 9s, and 9 Boeing 737-700s, compared to a fleet of 102 aircraft prior to the COVID-19 pandemic.

- Copa Airlines had an on-time performance for the quarter of 90.0% and a flight completion factor of 99.54%, once again positioning the airline among the best in the industry.

Subsequent Events

- In January, Copa Airlines was recognized by Cirium – for the eighth consecutive year – as the most on-time airline in Latin America in 2021. Copa Airlines’ on-time performance of 91.1% for the year was the highest of any carrier in the Americas.

- In January, the Company took delivery of one Boeing 737 MAX 9 aircraft, originally scheduled for December 2021.

- Due to the recent surge in COVID-19 cases in Panama and Latin America, mainly driven by the Omicron variant, which impacted its crew availability, the Company canceled over 1,000 flights, reducing the 1Q22 published schedule by approximately 4%.