Copa Holdings, S.A. (NYSE: CPA), announced financial results for the third quarter of 2022 (3Q22). The terms «Copa Holdings» and the «Company» refer to the consolidated entity. The following financial information, unless otherwise indicated, is presented in accordance with International Financial Reporting Standards (IFRS). See the accompanying reconciliation of non-IFRS financial information to IFRS financial information included in the financial tables section of this earnings release. Unless otherwise stated, all comparisons with prior periods refer to the third quarter of 2019 (3Q19) (which the Company believes are more relevant than year-over-year comparisons due to the significant impact of the COVID-19 pandemic in 2020 and 2021).

OPERATING AND FINANCIAL HIGHLIGHTS

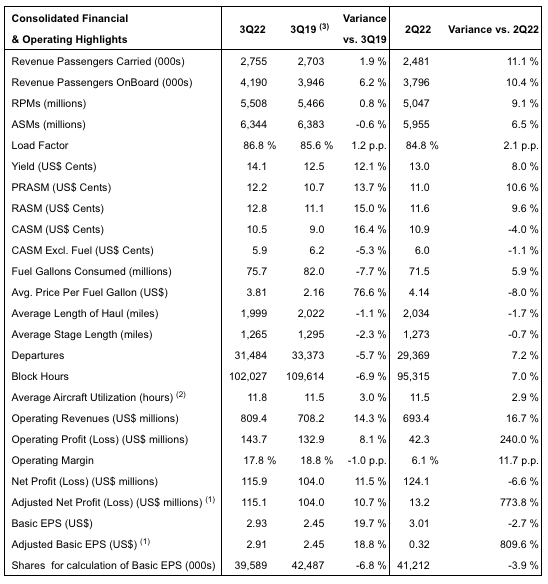

- Copa Holdings reported a net profit of US$115.9 million for the quarter or US$2.93 per share, as compared to a net profit of US$104.0 million or earnings per share of US$2.45 in 3Q19. Excluding special items, comprised of an unrealized mark-to-market net gain of US$0.9 million related to the Company’s convertible notes as well as changes in the value of financial investments, the Company would have reported a net profit of US$115.1 million or US$2.91 per share.

- Copa Holdings reported an operating profit of US$143.7 million for the quarter and a 17.8% operating margin, compared to an operating profit of US$132.9 million and an operating margin of 18.8% in 3Q19.

- Total revenues for 3Q22 increased 14.3% to US$809.4 million, as compared to 3Q19 revenues. Yields increased 12.1% to 14.1 cents and revenue per available seat mile (RASM) increased 15.0% to 12.8 cents.

- Operating cost per available seat mile (CASM) increased 16.4% from 9.0 cents in 3Q19 to 10.5 cents in 3Q22, driven by higher fuel prices. CASM excluding fuel (Ex-fuel CASM) decreased 5.3% in the quarter to 5.9 cents, as compared to 3Q19.

- Passenger traffic, measured in terms of revenue passenger mile (RPMs), increased by 0.8% compared to 3Q19, while capacity (ASMs) decreased by 0.6%. As a result, load factors for the quarter increased by 1.2 percentage points to 86.8%.

- During the quarter, the Company started operations in one new route — Felipe Angeles International Airport in Mexico City.

- The Company ended the quarter with approximately US$1.1 billion in cash, short-term and long-term investments, which represents 42% of the last twelve months’ revenues.

- The Company closed the quarter with total debt, including lease liabilities, of US$1.7 billion.

- During the quarter, the Company took delivery of one Boeing 737 MAX 9 aircraft, ending the quarter with a consolidated fleet of 95 aircraft – 67 Boeing 737-800s, 18 Boeing 737 MAX 9s, 9 Boeing 737-700s, and 1 Boeing 737-800 freighter, compared to a fleet of 102 aircraft prior to the COVID-19 pandemic.

- Copa Airlines had an on-time performance for the quarter of 86.6% and a flight completion factor of 99.5%.

Subsequent Events

- In October, the Company took delivery of one Boeing 737 MAX 9 and expects to receive one additional aircraft in November, to end the year with a total fleet of 97 aircraft.

- In October, Copa Airlines was recognized by Skytrax – for the seventh consecutive year – as the «Best Airline in Central America and the Caribbean» and as the «Best Airline Staff in Central America and the Caribbean.»

(1) Excludes Special Items. This earnings release includes a reconciliation of non-IFRS financial measures to the comparable IFRS measures.

(2) Average Aircraft Utilization is calculated based on the Company’s active fleet, excluding aircraft in storage.

(3) The Company believes that comparisons with 2019 are more relevant than year-over-year comparisons due to the significant impacts in 2020 and 2021 of the COVID-19 pandemic.